Customs and Customs Affairs

Customs is a governmental institution responsible for overseeing the import and export of goods in a specific country. These organizations enforce laws and regulations related to trade transactions with other countries and determine customs duties and taxes for imports and exports.

The duties of customs include the registration of imports and exports, enforcement of trade regulations and restrictions, calculation and determination of customs duties and tariffs, examination of the authenticity of goods, and taking measures to prevent smuggling. These actions, in a way, provide human, supervisory, and financial control over international trade to safeguard national security, domestic industry, the environment, and intellectual property rights.

Furthermore, customs plays a crucial role in facilitating international trade by ensuring that trade is conducted in an organized and legal manner through the implementation of specific laws and regulations. These organizations are essential for achieving the economic and business goals of countries, encouraging economic growth, and promoting trade between nations.

Customs affairs refer to a set of activities and tasks related to the supervision, control, and management of international trade and national borders. These affairs are carried out by customs organizations and institutions in each country. The importance of customs affairs lies in their role in ensuring national security, supporting domestic industry, controlling smuggling, and facilitating international trade.

Some aspects of customs affairs include:

Registration of Imports and Exports: Customs is responsible for registering goods and services entering or leaving the country. This process involves verifying information related to the goods, applying customs duties and tariffs, and determining currency values.

Enforcement of Trade Regulations and Restrictions: Customs enforces regulations and restrictions related to the import and export of goods. This includes health, safety, environmental, and intellectual property restrictions.

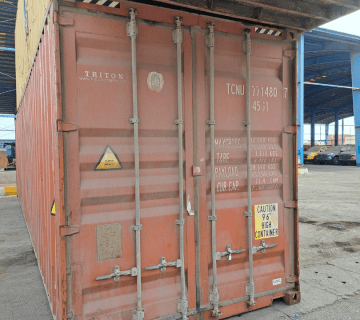

Measures to Prevent Smuggling: Customs takes actions to prevent the smuggling of goods and control illegal trade and tax evasion. These measures include inspections, import and export reviews, and the use of advanced technologies to control borders.

Facilitation of International Trade: Customs affairs should also facilitate international trade. This involves streamlining the process of commercial transactions, using electronic systems, and upgrading customs processes to enable smoother and more efficient trade.

then 'Add to home screen'

then 'Add to home screen' then 'Add to home screen'

then 'Add to home screen'

بدون دیدگاه